Health Conditions Most Affected by High Drug Prices

Soaring drug prices can devastate people who depend on prescriptions for chronic health problems. Some people even die. Here’s what you should know.

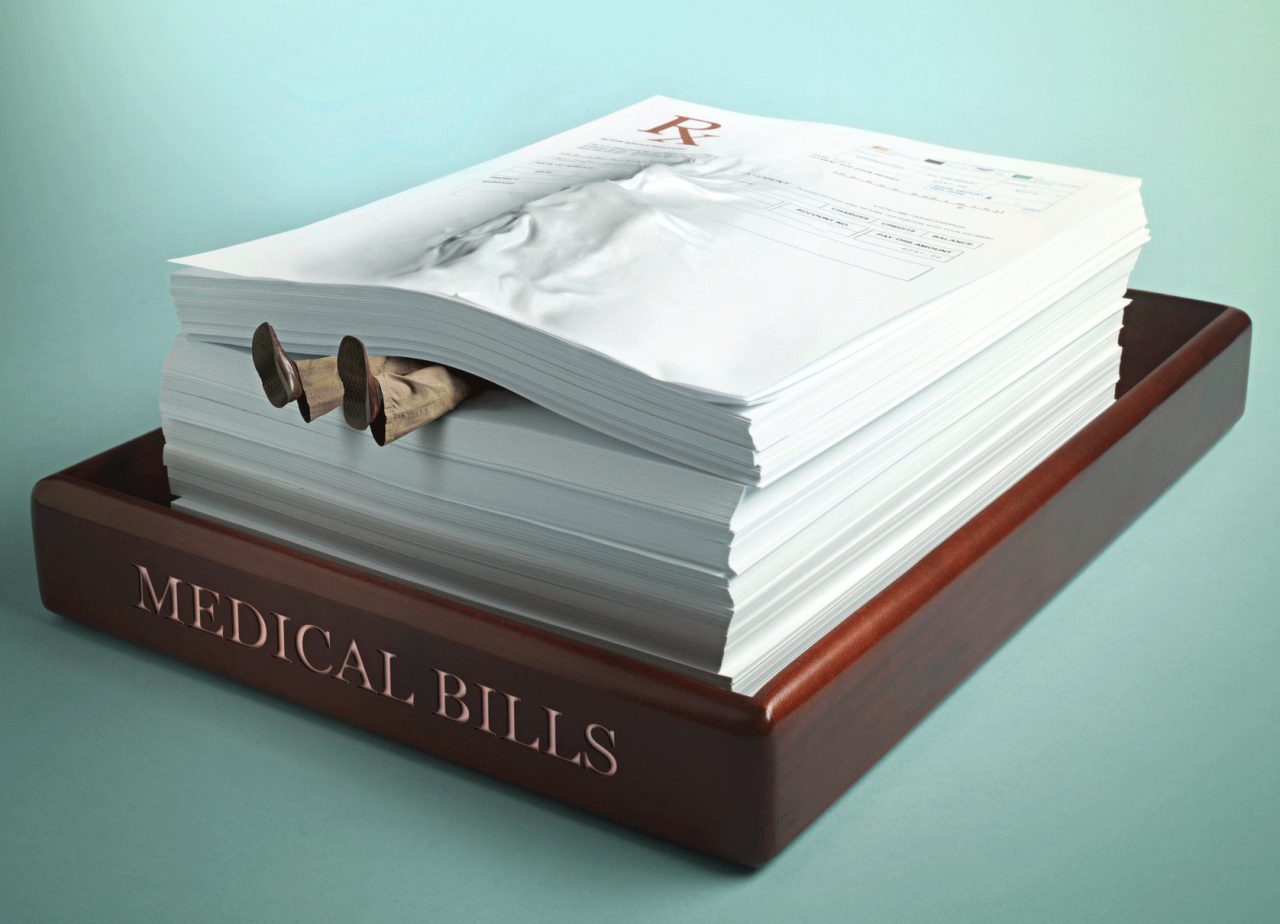

When drugs are expensive, the consequences can be tragic.

Many Americans need to pay the cost of drugs themselves. They lack insurance, have a high deductible, or their health insurance doesn’t cover their prescription. About half the time, people simply go without medication when their insurance plans won’t cover it,.

In one Gallup poll, about 23 percent of Americans said they didn’t have the money during the previous year to "pay for needed medicine or drugs that a doctor prescribed." Among women, that figure was 27.5 percent.

YOU MIGHT ALSO LIKE: Our Prescription Drug Prices section

Going without treatment can lead to death. In the same poll, more than 13 percent of American adults said that they know of at least one friend or family member who died during the past five years after not receiving medical treatment because they were unable to pay.

“One of the biggest contributors to poor health, hospital admissions, higher healthcare costs, and preventable death is patients failing to take their medications as prescribed,” said Timothy Lash, president of the West Health Policy Center.

Another study concluded that government negotiations with Medicare for lower drug prices, a process that began in 2023, could eventually save the lives of 94,000 seniors a year.

In an earlier study, researchers estimated about 125,000 deaths in the U.S. occur each year because people don’t take their medication, sometimes for lack of money.

Why high drug prices mean high risk for some conditions

When Alec Raeshawn Smith turned 26 and was no longer covered under his mom’s health insurance, he learned his insulin and other diabetes supplies would cost $1,300 a month.

Alec’s $35,000 a year salary was too high for Medicaid help or for assistance from Minnesota’s health insurance subsidies, his mom explained in a report from National Public Radio. He finally got insurance, for $450 a month. His annual deductible was $7,600.

Alec, who had type 1 diabetes, tried to ration his insulin. He was found dead in his apartment, three days before his pay day. The cause was diabetic ketoacidosis. Without enough insulin, his blood sugar levels spiked so high that his body shut down.

Such stories led to so much public pressure, Eli Lilly cut the cost of its most commonly prescribed insulins by 70 percent and expanded a program capping patient out-of-pocket costs at $35 or less per month.

An EpiPen, a way of injecting epinephrine, shuts down the allergic reaction anaphylaxis, which can kill. Generic epinephrine is covered under most Medicare and insurance plans, but it may still be expensive.

Sally Radoci, for example, learned that her insurance wouldn’t cover her brand name emergency allergy prescription. The cost was $600. She asked her pharmacist if she could get the generic version. “She said, ‘well, that's $398.’ And I said, ‘you're kidding.’ She said no. I said, ‘OK, then just forget it.’”

So now she gardens in long sleeves and pants, knowing a bee sting could kill her.

How high drug prices can affect cancer patients

Advances in cancer therapy have led to dozens of new oral medications with high prices.

Medicare beneficiaries in the Part D prescription drug program qualify for extra help once their costs reach a certain level — but before then, they must pay 25 percent of the price tag.

Given that some oral anticancer medications cost thousands monthly, patients eat up their funds quickly.

Pam Holt, a retired school principal, got by on credit cards. Three years before she expected to pay off her mortgage, she had to refinance her home to cover her costs.

Besides cancer, people run into trouble when they have specialty problems like “rheumatological disease, other autoimmune diseases, or advanced heart disease,” Carolyn McClanahan, MD, a Florida-based doctor, explained in an interview with CNBC.

Between 2016 and 2021, Americans paid for a 43 percent increase in the cost of specialty drugs, according to a government report.

Chronic health problems with high drug prices

Even ordinary problems and drugs can lead to cost burdens. Doctors prescribe medication for years for chronic illnesses.

Cholesterol-lowering statins and medications to treat high blood pressure can help prevent heart attacks and strokes. Anti-coagulants can reduce the odds a person with atrial fibrillation will have a stroke.

The catch is that you can’t skip doses. When people can’t afford their co-pays or lack health insurance, they may do just that. Retirees on low fixed incomes who take several drugs may even have trouble despite Medicare.

Manufacturers must now pay rebates to Medicare for Part D drugs if the cost goes up faster than inflation. The goal is to take away the incentive for those price hikes. Before the law, prices for more than 1,200 products rose faster than inflation, with an average increase of nearly 32 percent over a year.

McClanahan, who is also a financial advisor, suggests savvy shopping. Talk to your pharmacist about options. For example, if you can afford it, a 90-day supply is cheaper per day than buying enough for only 30 days. You may do fine with a generic, get a lower price buying from a Canadian pharmacy, or find a discount online through GoodRx.com.

You can also check with the company that makes your brand name drug for discount and patient-assistance programs.

Updated:

October 24, 2023

Reviewed By:

Janet O’Dell, RN